Life’s two unavoidables: death and taxes.

And while you may not be able to completely avoid tax, the savviest investors can significantly mitigate taxes by acquiring real estate.

Investing in real estate offers numerous financial benefits, not least of which are the significant tax advantages.

For individuals earning higher-than-average W-2 income, real estate investments can be a powerful tool to offset taxable income, reducing overall tax liabilities.

Here we will explore how real estate investments can help offset W-2 income, focusing on key tax benefits, cost segregation analysis, and types/structures of real estate investments that offer the best tax advantages.

Contents

Understanding W-2 Income and Tax Liabilities

W-2 income refers to the wages and salary income reported by employers on IRS Form W-2.

This income is subject to federal, state, and local taxes, and often results in substantial tax liabilities for earners.

And the higher the W-2 income, the greater the tax liability, particularly on the margin.

Reducing taxable income (typically via applicable tax deductions) is crucial for minimizing the overall tax burden.

Real estate investments offer effective strategies for achieving significant tax savings.

Key Tax Benefits of Real Estate Investment

Real estate investments provide several tax benefits that can significantly reduce taxable income for W-2 earners.

Depreciation

Depreciation is a non-cash deduction that allows real estate investors to deduct the cost of the property over its useful life.

Residential rental properties can be depreciated over 27.5 years.

Commercial properties are depreciated over 39 years.

Straight-line depreciation reduces taxable income, lowering the overall tax liability.

However, 27.5 and 39 years is a LONG time to recapture depreciation expense.

Other strategies exist for front-loading depreciation. We will discuss cost segregation and bonus depreciation further in a moment.

Mortgage Interest Deduction

The mortgage interest deduction allows real estate investors to deduct the interest (not principal) paid on loans used to acquire or improve rental properties.

This deduction can be substantial, especially in the early years of the mortgage when interest payments are highest, thereby reducing taxable income.

Now that interest rates are elevated, the mortgage interest deduction is even more critical for borrowers.

Property Tax Deduction

While it may go without saying, it still should be included: real estate investors can deduct property taxes paid on rental properties.

This deduction further reduces taxable income and can result in significant tax savings.

Cost Segregation Analysis

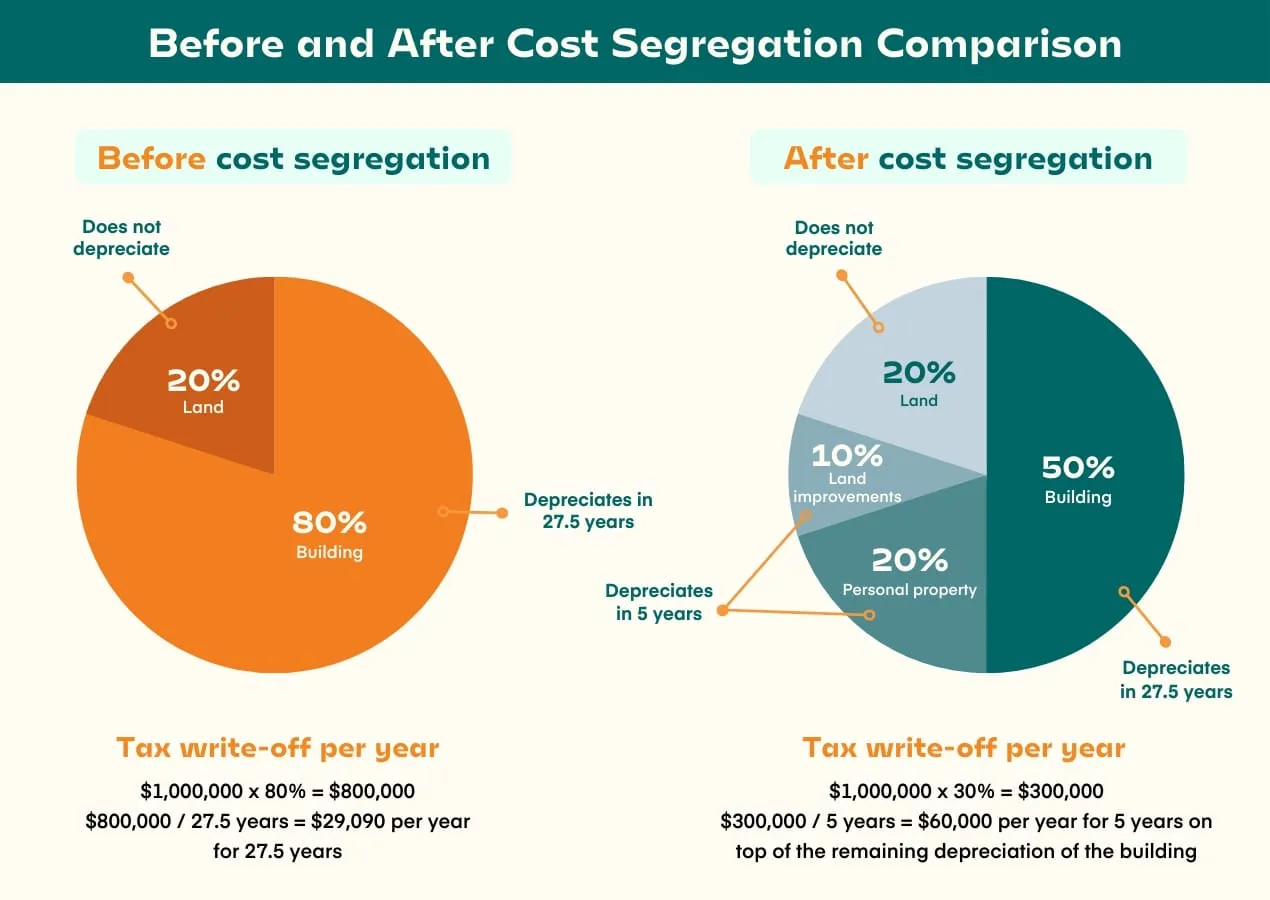

Cost segregation analysis is a strategic tax planning tool that accelerates depreciation by identifying and reclassifying personal property assets to shorter recovery periods.

By breaking down the components of a property, such as electrical systems, plumbing, and landscaping, into shorter depreciation schedules, investors can significantly increase depreciation deductions in the early years of ownership.

In recent years, the Biden Administration has also enhanced cost segregation with bonus depreciation.

In order to extract accelerated bonus depreciation, there are a few critical steps.

Steps Involved in a Cost Segregation Study

- Engage a Professional: Hire a cost segregation expert. The cost segregation analysis cannot be done on your own. You need a professional, experienced with the process.

- Property Analysis: Conduct a thorough analysis of the property to identify components eligible for accelerated depreciation. Again, professional assistance is critical here.

- Reclassification: Reclassify identified components into shorter depreciation schedules rather than the typical 27.5 and 39 years.

- Tax Filing: Incorporate the results of the cost segregation study into tax filings.

Examples of savings through cost segregation can be substantial, often resulting in tens of thousands of dollars in tax savings in the first few years of ownership.

The savings are further enhanced when leverage is involved.

For instance, when 20-25% is equity is included in the property, cost segregation can sometimes be used to offset most or all of the property’s down payment.

Savvy investors can preemptively plan how to best strategize with their real estate agent and CPA to perfectly optimize your real estate acquisitions.

Types of Real Estate Investments for Tax Benefits

Different types of real estate investments offer varying tax benefits.

Here are a few that are particularly effective in offsetting W-2 income:

Residential Rental Properties (Including Turnkey Properties)

Investing in residential single family rental properties allows investors to take advantage of cost segregation depreciation, mortgage interest, and property tax deductions.

Both long-term and short-term (think VRBO and/or AirBNB) rentals can provide significant tax benefits.

Reminder: we offer turnkey real estate properties available for investment.

Commercial Properties

Commercial real estate investments offer substantial tax deductions, including accelerated depreciation through cost segregation, higher mortgage interest deductions, and significant property tax deductions.

For the highest W-2 earners, commercial properties can provide a faster and more efficient means of getting the write-offs you need.

The one alternative is acquiring the equivalent volume of single-family residential properties.

The problem with the quantity strategy is each transaction has its own closing and financing costs, which can decrease returns (admittedly, commercial properties are not good candidates for the one percent rule).

Multifamily Properties

Multifamily properties, such as apartment buildings, provide multiple streams of rental income and allow for substantial tax deductions.

These properties also benefit from larger cost segregation analysis, enhancing tax savings.

Real Estate Investment Trusts (REITs)

REITs offer a way to invest in real estate without directly owning property.

REITs must distribute at least 90% of their taxable income to shareholders, resulting in dividends that can be tax-advantaged.

Additionally, some REIT distributions may be considered return of capital, reducing taxable income.

But, keep in mind, some of the cost segregation and accelerated depreciation benefits may not be available.

Other Strategies to Maximize Tax Benefits

Several strategies can help real estate investors maximize tax benefits and offset W-2 income:

Utilizing 1031 Exchanges

A 1031 exchange allows investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into another like-kind property.

A 1031 exchange can significantly defer tax liabilities and enhance investment growth over time.

Investing in Opportunity Zones

Opportunity zones are designated areas that offer tax incentives to encourage investment. Investors can defer and potentially reduce capital gains taxes by investing in qualified opportunity zone properties.

Implementing Passive Activity Loss Rules

Passive activity loss (PAL) rules allow investors to offset passive losses against passive income.

Real estate investments, classified as passive activities, can generate losses that offset other passive income, thereby reducing overall taxable income.

Risks and Considerations

While real estate investments offer significant tax benefits, they also come with risks. Potential risks include market fluctuations, property management challenges, and changes in tax laws. Conducting thorough due diligence and seeking professional advice is essential for mitigating these risks and making informed investment decisions.

Conclusion

Investing in real estate provides powerful tools for offsetting W-2 income and reducing overall tax liabilities.

By leveraging depreciation, mortgage interest deductions, property tax deductions, and strategic tax planning tools like cost segregation analysis, real estate investors can mitigate tax liabilities.

With careful planning and professional guidance, real estate investments can be a cornerstone of a successful tax strategy and long-term financial planning for capital growth and retirement.

- How to Offset W-2 Income Taxes by Investing in Real Estate - July 19, 2024

- How to Invest in Real Estate Sight Unseen - July 16, 2024

- 19 Reasons Foreigners Should Invest in US Single-Family Real Estate - July 11, 2024