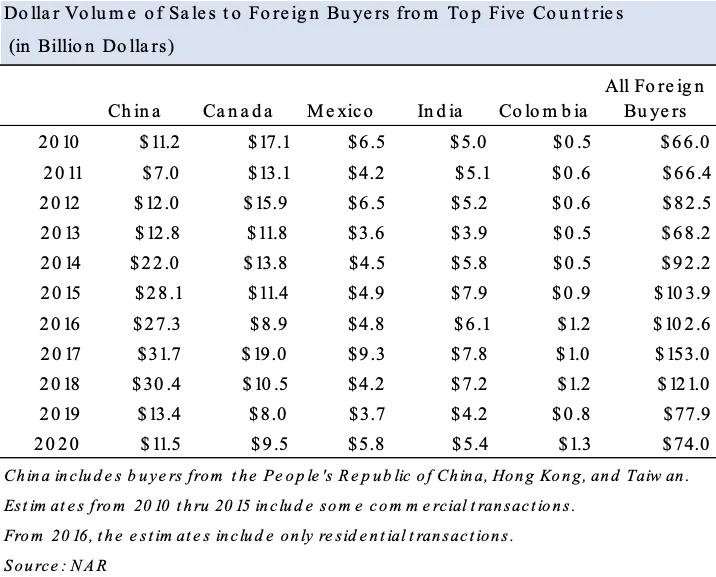

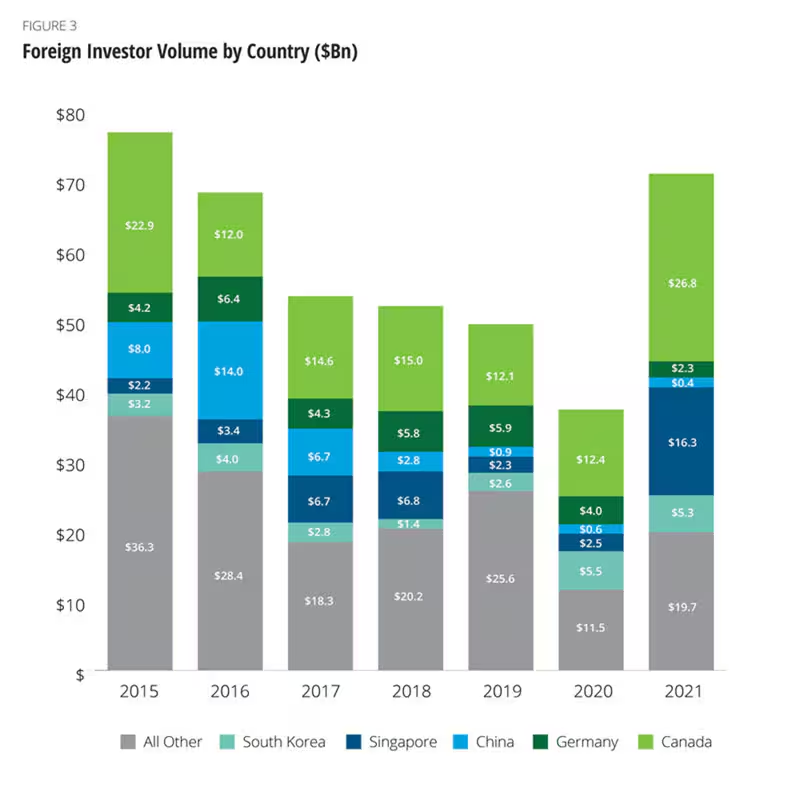

In recent decades, the number of foreign investors entering the single-family real estate market has surged.

But that rise in real estate foreign investment rise saw a sharp decline as real estate valuations ballooned during and after the pandemic.

A report from the National Association of Realtors found that foreign buyers purchased $74 billion worth of U.S. existing homes through 2020. .

While foreign buyer confidence in US single family real estate has seen ups and downs, foreign buyer sentiment remains, particularly among Chinese buyers.

There are numerous reasons single-family real estate can be an attractive investment option for foreign buyers.

From the stability and security of this market to the diverse benefits of portfolio diversification, single-family homes offer unique advantages that make them a compelling choice for international investors.

Here’s why.

Contents

- Historical Stability

- Economic Stability of Developed Markets

- Legal Protections

- Risk Management

- Geographical Diversification

- Rental Income & Cash Flow

- Low Vacancy Rates

- Market Trends

- Renovation & Value-Add Opportunities

- Depreciation & Deductions

- Tax Treaties

- 1031 Exchange

- Mortgage Availability

- Favorable Interest Rates

- Property Management Services

- Software & Technological Advancements

- Short-Term Rental Opportunities

- Dual Use Property

- Cultural & Lifestyle Benefits

- Conclusion

Historical Stability

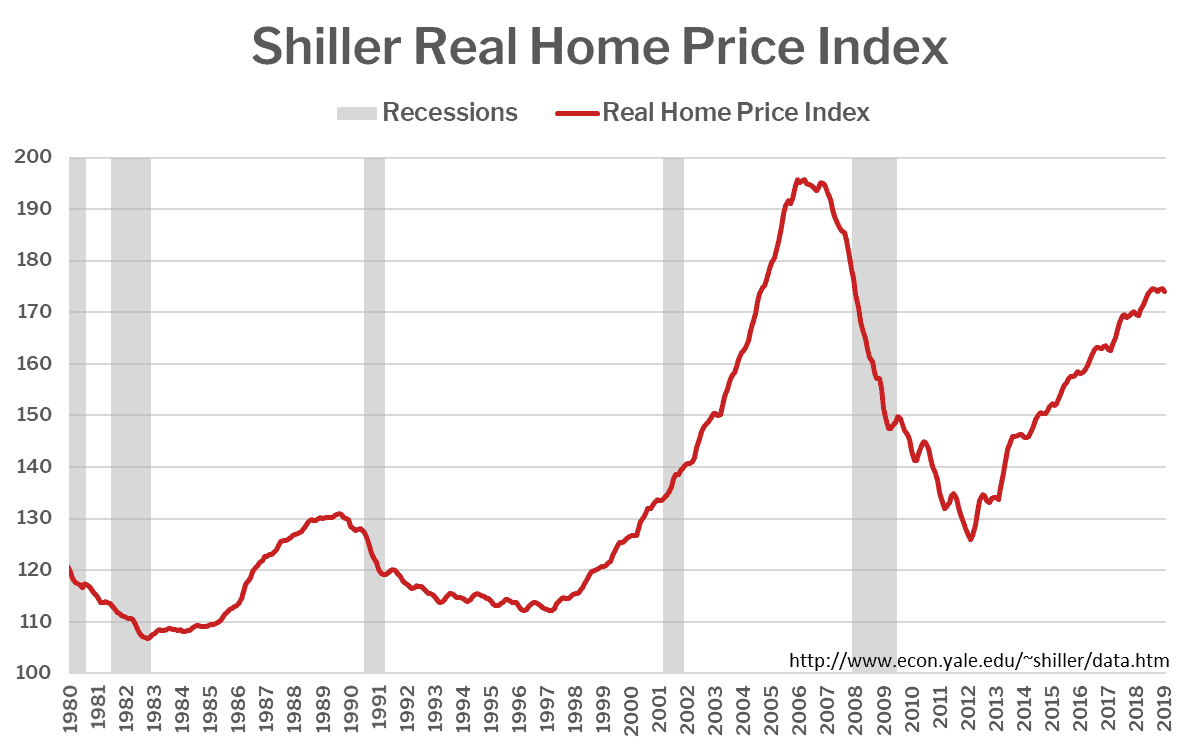

In the United States, single-family homes have had a long history of stable performance and appreciation.

With one exception:

Unlike other investment options (e.g. cryptocurrency) that can be highly volatile, single-family real estate tends to appreciate steadily over a long time horizon.

Historical data shows that, even during economic downturns, the value of single-family homes typically recovers and continues to grow, making them a reliable foreign investment choice.

But the historical stability of the United States, even during downturns, is even greater when compared to the relative instability of other foreign markets.

Economic Stability of Developed Markets

Investing in single-family real estate in developed markets offers additional layers of economic stability.

Countries like the United States have robust economies and well-regulated real estate markets.

These regulated markets provide a much more secure environment for foreign investors seeking returns abroad.

Foreign investors in US single family homes can thus better ensure their foreign investments are protected and have the potential for steady growth.

Legal Protections

Complain all you want about US politics, but the US legal system is much more favorable than other nations when it comes to the protection of private property.

Foreign investors in single-family real estate benefit from strong legal protections in developed markets like the United States.

In most jurisdictions, property rights are well-defined and enforced, ensuring that investors have clear ownership and control over their properties.

This legal framework reduces the risk of disputes and provides a secure foreign investment environment.

It also encourages greater and more frequent investment in stable areas with solid legal protection.

Trust is everything, especially when it comes to investing.

Risk Management

Risk mitigation is everything in investment management.

Real estate investing is no exception.

And diversification is one of the best ways to mitigate foreign investment risk.

Diversifying any foreign investment portfolio with single-family real estate can help manage risk.

Real estate is often uncorrelated (i.e. behaves differently) from other asset classes like stocks and bonds, providing a hedge against market volatility, including inflation.

This diversification can stabilize an foreign investor’s portfolio and reduce overall risk.

Geographical Diversification

Investing in single-family real estate outside of one’s home country offers geographical diversification.

This strategy spreads risk across different markets and economies, reducing the impact of localized economic downturns.

It also provides exposure to markets with high(er) growth potential that may not be available domestically.

Rental Income & Cash Flow

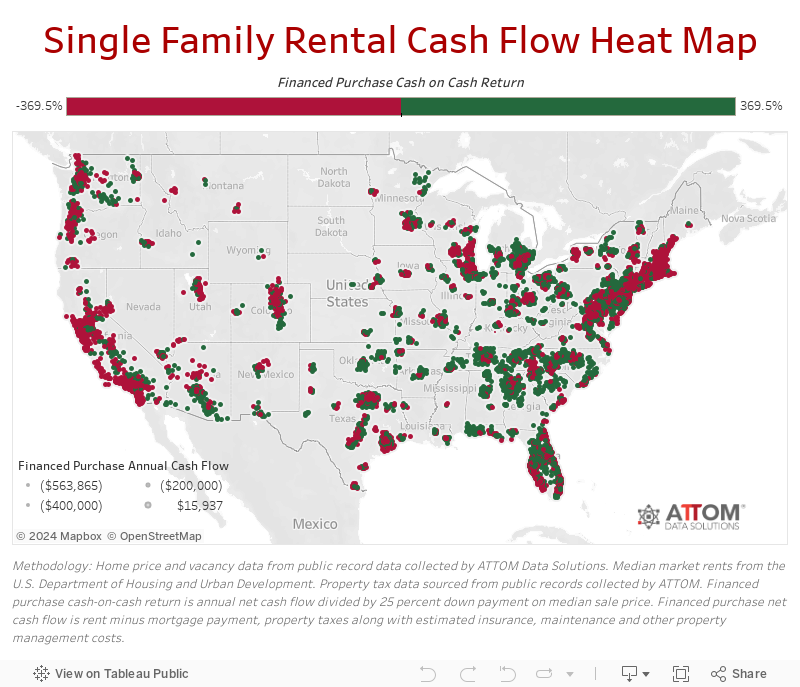

Single-family properties can generate consistent rental income, providing a reliable cash flow stream for investors.

This passive income can help cover mortgage payments, property maintenance, and other expenses while also offering the potential for profit.

And, depending on where the foreign investor resides, holding the single family rental real estate cash flow in US dollars and banks may prove further helpful.

Low Vacancy Rates

Desirable local markets often have lower vacancy rates, ensuring that rental properties remain occupied and generate steady income.

High demand for single-family rentals can lead to higher cap rates and better returns over a longer period.

Market Trends

Cash flow isn’t everything.

Especially for investors looking to cover gains with loses for tax purposes.

Single-family real estate markets in many developed countries have shown strong appreciation trends over long periods.

Foreign investors should be including this in their returns.

By analyzing market data and investing in areas with high growth potential, investors can capitalize on rising property values and increase their investment’s equity over time via appreciation.

Renovation & Value-Add Opportunities

Single-family homes offer opportunities for renovations and value-add projects.

The rehab model remains a bit more muted, but it is alive and well.

Investors can purchase properties that need improvements, make strategic upgrades, and significantly increase the property’s value.

This approach can lead to substantial appreciation and higher returns on investment.

This is particularly true in markets where the underlying economics of the area and neighborhood are sound.

Depreciation & Deductions

Tax advantages abound in real estate.

Real estate investors can take advantage of various tax benefits, including depreciation and deductions for expenses related to property management and maintenance.

These tax advantages can reduce the overall tax burden and enhance the investment’s profitability.

Tax benefits are available to both domestic and foreign buyers alike.

Tax Treaties

Many countries have tax treaties that favor foreign real estate investors, reducing the risk of double taxation.

These treaties often provide favorable tax rates and exemptions, making it more attractive for international investors to enter the single-family real estate market.

In some cases, and for the right amount and structure, citizenship is also offered on certain foreign real estate investments (even if they’re not all single family properties).

1031 Exchange

The 1031 exchange is a powerful tax-deferral strategy available to real estate investors in the United States.

This rule also applies to foreign investors as well.

The 1031 exchange allows investors to defer capital gains taxes by reinvesting proceeds from the sale of one property into another similar property.

This benefit can significantly enhance long-term investment growth and wealth accumulation for foreign investors.

Mortgage Availability

Foreign investors can access a variety of financing options, including mortgages specifically designed for non-residents.

Many banks and financial institutions offer loans to foreign buyers, making it easier to enter the single-family real estate market without the need to make cash offers.

But additional terms may apply, depending on the type of your real estate transactions.

Favorable Interest Rates

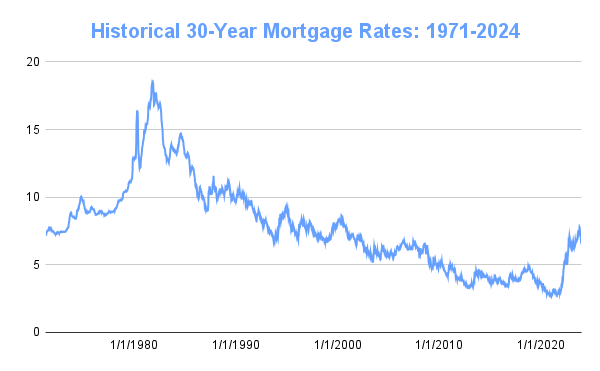

Even with the elevated interest rate environment, current trends in interest rates can benefit real estate investors.

With interest rates remaining relatively low, foreign investors can secure affordable financing, reducing the cost of borrowing and increasing potential returns on investment.

Property Management Services

Professional property management services can handle the day-to-day operations of single-family rental properties:

- Tenant screening

- Rent collection

- Maintenance and repairs

Outsourcing your property management to a local, trusted partner allows foreign investors to enjoy passive income without the hassle of managing the property themselves–typically from long distances.

Software & Technological Advancements

Software tools and platforms have made remote property management more accessible than ever.

In today’s market, there are software solutions to help foreign investors deal with all the complexities of the lifecycle of a foreign real estate investment, including:

- Sourcing & Acquisition. Make more informed and educated buying decisions by bridging the gap in information asymmetry between real estate buyers and sellers.

- Construction. Construction and rehabilitation management software can allow repair and rent investors to more efficiently operate the construction and rehab process.

- Property Management. A nearly innumerable world of options is available for managing your US-based single-family investment property.

- Portfolio Management. For investors that acquire multiple residential properties, you can look at both your returns and assets from 50,000 feet, better understanding how you can grow and further optimize.

- Disposition. Foreign investors can better liquify, dispose and transfer underperforming properties.

Investors can monitor their properties, communicate with tenants, and handle administrative tasks remotely, regardless of their physical location.

The US real estate market is home to some of the most robust software available for optimizing real estate investing.

Short-Term Rental Opportunities

The rise of short-term (ST) rental platforms like Airbnb and VRBO have opened new opportunities for single-family home investors.

Properties in popular tourist destinations or business hubs can be rented out on a short-term basis, often at higher rates than long-term rentals, boosting overall returns.

These ST rentals can also have a duel-use.

Dual Use Property

Investing in single-family real estate offers the potential unique advantage of dual use.

Foreign real estate investors can rent out their property for income while also having the option to use it as a vacation home.

This dual-use flexibility allows investors to enjoy their investment personally while still generating rental revenue.

But, keep in mind, this typically only works for short-term rental homes (i.e. AirBNB or VRBO).

Cultural & Lifestyle Benefits

Owning property in a foreign country provides opportunities to experience different cultures and lifestyles.

Owning property in the United States is certainly no exception.

This can be particularly appealing for investors who seek to spend part of the year in another country, enjoying the benefits of both investment and personal enrichment.

But unless your property investment is a short term rental, then the property itself may be more of a catalyst to visiting and not the rental you use when you arrive!

In many cases, foreign real estate investors look to the US market and a fast-track toward green card status.

Conclusion

Single-family real estate offers a range of compelling benefits for foreign investors looking to enter the US market.

Some of the benefits include stability, diversification, passive income, appreciation potential, tax advantages, financing opportunities, ease of management, and personal use.

As the global real estate market continues to evolve, now is an excellent time for foreign investors to explore opportunities in single-family real estate.

That’s why we created a marketplace for turnkey real estate investors for both foreigners and out-of-state rental investors.

Whether you’re looking for a stable investment, a way to diversify your investment portfolio, or a property that offers both income and personal enjoyment, single-family homes can provide an option.

If you’re among the pool of strong international buyers, consider connecting with the team at Invest.net regarding your real estate investment goals.

- How to Offset W-2 Income Taxes by Investing in Real Estate - July 19, 2024

- How to Invest in Real Estate Sight Unseen - July 16, 2024

- 19 Reasons Foreigners Should Invest in US Single-Family Real Estate - July 11, 2024