In the United States, real estate has always been an attractive investment option. Housing prices seem to go up perpetually, thanks in part to the economic dominance of this country.

That said, over the last 20 years, certain economic events have caused people to question the stability of housing market growth, and treat the real estate market as more volatile. On any given day, you can find articles proclaiming the greatness of the real estate market or sewing fears about a forthcoming crash.

There are always reasons for both optimism and pessimism, but we need to consider them in balance with each other to make reasonable forecasts about the future of the real estate market. In this article, we’ll present several powerful reasons for optimism in the U.S. housing market broadly, as well as a handful of counter arguments that also make logical sense.

As a real estate investor, it will be on you to weigh these factors in balance with each other so that you can make more effective real estate investing decisions.

Contents

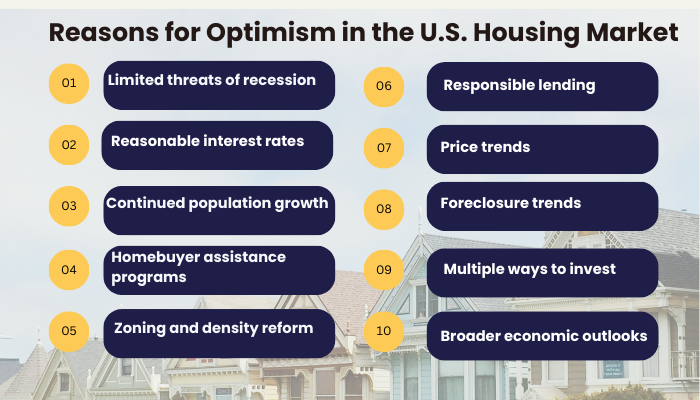

Strong Reasons for Optimism in the U.S. Housing Market

These are some of the strongest reasons for optimism in our housing market:

- Limited threats of recession. After the 2007-8 housing market collapse and subsequent economic recession, people began to associate real estate market performance and broader economic performance more closely than ever before. While these realms can function somewhat independently, there’s no question that they can have an impact on each other period if the economy is doing poorly enough, people won’t have enough money to buy real estate, or they may be too pessimistic to buy such large assets. And of course, if the real estate market collapses, people’s net worth will decline, and they’ll be less incentivized to take risks with the money they have left, negatively impacting the economy. For now, the threat of a recession is greatly limited. The economy seems to be performing adequately, volatility is down, and there aren’t many foreseeable major threats on the horizon to think that an economic recession is coming. Of course, even a strong economic recession may not have a severe impact on the housing market.

- Reasonable interest rates. Interest rates are currently reasonable. They aren’t especially high, and they aren’t especially low, though they’ve been through a series of adjustments since the COVID-19 pandemic. During and shortly after the pandemic, interest rates were incredibly low, causing a frenzy of buyers to enter the market and gobble up as much real estate as possible. While this was incredibly good for holders of real estate at the time, it also caused some downstream consequences, including surging real estate prices and greater reluctance to sell once people locked in those super low interest rates. High interest rates have similar tradeoffs, mitigating some of the consequences of easy money but also stifling demand. Right now, interest rates are at a level to facilitate home sales, home purchases, and decent inventory turnover. However, it’s not exactly clear where interest rates are going from here.

- Continued population growth. The population growth rate isn’t as high as it once was, but our country’s population is still growing – and likely will continue to grow well into the future. Birth rates are slowing down, which is a factor we’ll address in the next section, but immigration remains high enough to counteract this. One of the biggest reasons for continued real estate market growth in the United States is our constantly increasing population; with a finite amount of land and more people who need to occupy that land, it’s only natural that the prices of houses go up. For now, there’s no reason to think that population growth is going to stagnate, or that it’s going to decline in the near future.

- Homebuyer assistance programs. We’ve also seen the rise and propagation of homebuyer assistance programs. There are many incentives out there for ambitious homebuyers who want to purchase their first home, but who might financially struggle with current market conditions. In the future, we may see the development of even more home buyer assistance programs, facilitating even more transactions from people who might not otherwise be able to afford a home. This causes a spike in demand, increases the total number of home buyers, and ultimately allows for the real estate market to function in a healthier way.

- Zoning and density reform. You can also derive optimism from zoning and density reform in many areas across the United States. Recognizing the absurdly high prices of homes, many urban areas are making adjustments to facilitate more construction and development of housing inventory. This can put downward pressure on existing real estate, but it also presents excellent buying opportunities for investors.

- Responsible lending. One of the biggest reasons why the housing market collapsed in 2007 was irresponsible lending practices from big banks all around the country. Banks were giving more variable interest rate loans and were lending to people who probably shouldn’t have qualified for such big mortgages. Mortgage-backed securities were more proximately responsible for the housing market collapse, but it’s only because so many people were foreclosing that these securities began to underperform so aggressively. It seems that financial institutions have learned their lesson, as banks have committed to much more responsible due diligence and better lending practices since this time. Irresponsible lending and mortgage-backed securities aren’t the only ways that the real estate market could collapse, but it’s still nice knowing that we probably won’t be victims to the same problem twice.

- Price trends. Pricing trends also give us reason to be optimistic about the future of the real estate market. Individual neighborhoods vary, of course, but broadly speaking, housing prices in the United States are steadily trending upward. If the price growth rate was more exaggerated or more volatile, we might have reasonable concerns about a bubble being formed. If growth was stagnant or if the real estate market was in decline, we could easily speculate about such trends persisting in the future. But right now, we have excellent momentum that doesn’t present any new causes for concern.

- Foreclosure trends. Foreclosure trends are variable as well. Perhaps in part due to more responsible lending practices and consumer lessons from the 2008 market crash, people are foreclosing on their homes less and less. This enables more people to come to the real estate market with high net worth and high buying power, facilitating smoother transactions along the way.

- Multiple ways to invest. These days, there are more ways to invest in real estate than ever before. If you’re searching for a property to buy, you can do some research online and come up with hundreds, if not thousands of prospective options, depending on your search parameters. If you don’t like the idea of buying and managing real estate on your own, you can invest remotely with the help of a property management company. Also, with real estate investment trusts (REITs), you can get indirect exposure to the real estate market and mitigate some of the problems associated with buying properties individually; shares of REITs can be bought and sold like shares of stock, so there are very minimal capital requirements and much higher liquidity in play.

- Broader economic outlooks. Overall, the future of the economy looks good. Economic growth isn’t as powerful as it was a few decades ago, and there are always international political issues to sort out. But as it stands, in this country, we can reasonably anticipate further economic prosperity and growth for at least the next several years. Though it’s not always the case, it’s often true that when the economy does well overall, so does the real estate market.

Compelling Counters From Pessimists

These are some of the most compelling counters you’ll hear from pessimists on the other side of the issue:

- Generally high prices. Critics are correct to cite generally high prices across the real estate market. Yes, this can be a good thing for people who hold real estate, but it’s also a very high barrier to entry for new real estate investors. People are buying their first home much later in life, and fewer people are able to afford houses of their own, generally decreasing demand. High real estate prices also get passed down to tenants in the form of higher rent prices, stifling their ability to save up a down payment for a home of their own. Such a course is arguably unsustainable, as impossibly high prices can bring the real estate market to a grinding halt. But for now, we may still be decades away from such stagnation.

- Changes in Fed policy. Federal Reserve actions are highly influential in the real estate market. Even a tiny change in the federal funds rate can cause mortgage interest rates to rise or fall, motivating millions of people to make different real estate decisions at the end of this chain of dominoes. The Fed has made some interesting decisions lately, slashing interest rates to near zero, then pumping them up, and then wavering about whether to cut them and how much to cut them. It’s not exactly clear what the Fed is going to do from here, but major deviations from public expectations could have a chaotic impact on the housing market. The uncertainty of it all makes it much harder to make rational decisions.

- Broader supply issues. Many areas of the country are also dealing with supply issues. People who locked in low interest rates are reluctant to sell. New construction is generally declining and is getting harder to manage. Without ample inventory, the real estate market can’t move, and if the real estate market can’t move, it can’t really progress. There are some solutions to this problem already in place, such as changes in Fed policy, motivation to pursue new construction, and changes in local laws and regulations, but as it stands, supply isn’t as abundant or as free-flowing as most real estate investors would like it to be.

- More fees and red tape. In some ways, it’s more expensive and more complicated to buy a home than ever before. Alternative real estate investment products like REITs are great for mitigating this, but at the bottom of those financial structures, buying and selling real estate is still somewhat expensive. Most people buying and selling properties have multiple fees to pay for and lots of red tape to deal with.

- Declining birth rates. And as we alluded earlier, the United States has been suffering from declining birth rates for many years now. People aren’t having as many kids as they once did, which could lead to population stagnation or decline – especially if immigration numbers drop. Broad real estate market growth depends on income depends on increasing populations, so if populations stagnate or decline, it could spell bad news for the real estate market. However, this factor isn’t likely to come into play for many years to come.

The Real Estate Market Can’t Be Concretely Predicted

There are always conflicting signs and signals, and even if there weren’t, the real estate markets can sometimes behave in unpredictable ways, especially when there are invisible or unknowable factors in play. The truth is, the real estate market can’t be concretely predicted, even with the help of expert economists and real estate agents on your side.

That said, the more information you have access to, the better the decisions you can make. As an individual with modest or limited real estate investing experience, you may not have access to all the information and perspective you need to flesh out your real estate portfolio strategically.

That’s why it pays to have the help of experts like real estate agents and economists, even if they aren’t perfect in their predictions all the time.

If you’re ready to talk to one of our seasoned real estate investing experts, you can start the conversation today!

- 10 Reasons for Optimism in the U.S. Housing Market (and Compelling Counters) - December 10, 2024

- Is This Real Estate Property Truly Turnkey? 13 Things to Check - November 8, 2024

- Are “As Is” Properties Worth Considering as a Real Estate Investor? - October 28, 2024