Passive income from rental properties

Maximize and diversify your portfolio — unlock the equity growth, asset appreciation and tax benefits of real estate by investing in turnkey rental properties.

As Seen In

A TRULY DIVERSIFIED PORTFOLIO

Turnkey Real Estate Investing

Why turnkey real estate

investing?

In a world chasing yield and running from inflation, you need a portfolio with greater exposure to a diversified pool of private investments, including real estate.

By adding actively-managed turnkey real estate to your investment portfolio, you increase the potential of bolstered returns, capital appreciation, tax optimization and enhanced portfolio diversification.

You Invest, We Handle the Rest

Avoid the hassles of renters, rehabs and individually managing your property portfolio.

Reap the immediate benefits of investing in income-producing real estate without the hassles of property management.

Whether you’re navigating your first turnkey real estate investment or you’re simply looking for diversification in an existing real estate portfolio, we can help.

It is critical to work with an experienced and knowledgeable turnkey investment company with your best interest in mind.

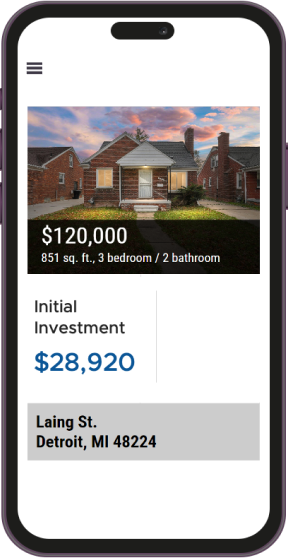

Available Investments

Pinyon Point Property Investment Opportunity

- 3

- 2.5

- 1500 SQ, FT

- Property Type: Single Family Rental

- Purchase Price:$640,000

- Expected ROI:

- Downpayment:$128,000

- Location:Catawba, NC

Duplex Investment Opportunity in Kings Mountain, NC

- 6

- 4

- 2892 SQ, FT

- Property Type: Single Family Rental

- Purchase Price:$544,900

- Expected ROI:37.9%

- Downpayment:$136,225

- Location:Battleground Ave Kings Mountain, NC

Investment Property in Catawba, NC

- 3

- 2.5

- 2174 SQ, FT

- Property Type: Single Family Rental

- Purchase Price:$439,900

- Expected ROI:44.1%

- Downpayment:$109,975

- Location:Ron Whicker Dr Catawba, NC

Avoid the Struggle of Sourcing, Acquiring & Managing Your Real Estate Investments

When you invest with us, you avoid the hassles and struggle of remotely sourcing and managing your investments. Gain immediate access to lucrative real estate investments in top-performing U.S. real estate markets.

How it Works

A simple, proven & repeatable real estate investing process

Expected ROI:

36%

Cash Flow:

$625

Search and find properties that meet your unique ‘buy-box’ criteria for passive investment

- Learn We are here to help our clients learn the opportunities and risks associated with the real estate asset class, including deep financial analysis and due diligence on each of your target properties.

- Strategize Schedule a time to meet with a member of our experienced team. Your call with go over your current portfolio, source of funds and overall investment goals. We’ll tailor select investments that may match your personal goals. Our real estate investment strategies are custom-tailored to fit within your goals and risk profile.

- Invest Invest on your terms and in the markets that best match your investment analysis and long-term strategy. We offer exposure to a variety of investment markets, products and structures that can help enhance and grow equity, generate income and preserve wealth.

Avoid the Struggle of Sourcing, Acquiring & Managing Your Real Estate Investments

When you invest with us, you avoid the hassles and struggle of remotely sourcing and managing your investments. Gain immediate access to lucrative real estate investments in top-performing U.S. real estate markets.

How it Works

A simple, proven & repeatable real estate investing process

Expected ROI:

36%

Cash Flow:

$625

Search and find properties that meet your unique ‘buy-box’ criteria for passive investment”

- Learn We are here to help our clients learn the opportunities and risks associated with the real estate asset class, including deep financial analysis and due diligence on each of your target properties.

- Strategize Schedule a time to meet with a member of our experienced team. Your call with go over your current portfolio, source of funds and overall investment goals. We’ll tailor select investments that may match your personal goals. Our real estate investment strategies are custom-tailored to fit within your goals and risk profile.

- Invest Invest on your terms and in the markets that best match your investment analysis and long-term strategy. We offer exposure to a variety of investment markets, products and structures that can help enhance and grow equity, generate income and preserve wealth.

About

A team of investors that succeeds when you succeed

We best succeed when our clients succeed. We’re a group of passionate real estate investors that truly cares about our clients’ long-term investment goals.

Performing Assets

“ If I had a way of buying a couple hundred thousand single family homes and had a way of managing them…I would load up on them. ”

Warren Buffett