Turnkey real estate investing has emerged as a popular strategy among more wealthy investors seeking a hands-off approach to rental property investment.

This investment method involves purchasing a property that is fully renovated, managed by a professional company, and often already has stabilized rents with tenants in place, with the most ideal turnkey real estate prospects providing immediate positive cash-flow on day one after your rental property acquisition.

While turnkey investing offers several advantages, it is critical to understand both the benefits and potential drawbacks before taking the plunge.

Here, we outline some of the pros and cons of turnkey real estate investing.

Contents

What is Turnkey Real Estate Investing?

Turnkey real estate investing refers to buying properties (typically multi or single family investments) that are either newly developed or fully renovated and ready to rent out (or, ideally, already rent-stablized).

These properties are typically managed by professional property management companies, making the investment process straightforward and passive.

Unlike traditional real estate investments, where the investor is involved in rental property development, renovation and management, turnkey real estate properties offer a seamless experience where everything is taken care of by the turnkey provider.

Pros of Turnkey Real Estate Investing

There are a number of benefits to investing in true turnkey properties.

Immediate Rental Income

One of the significant advantages of turnkey real estate investing is the potential for immediate rental income without the need to wait for returns to materialize.

Since these properties are often sold with existing, paying tenants, real estate investors can start earning rental income immediately.

This immediate cash flow can be particularly appealing for those looking to see quick returns on their investment.

Hands-off Investment

Turnkey properties are ideal for investors seeking a hands-off approach.

Property management services are usually included as part of the full-service offering, meaning investors avoid day-to-day management headaches.

This convenience allows investors to enjoy passive income without the hassles of acting as an active landlord.

In many cases, hands-off also can mean “eyes off.” For instance, many investors will acquire and invest in properties out-of-state

Professional Development, Renovation and Management

Turnkey properties are typically developed and/or renovated by professionals, ensuring that the turnkey property is rented in a quality condition.

This professional touch extends to turnkey property management, where experienced managers handle maintenance, rent collection, and tenant relations.

Investors can rest assured that their rental property is being well taken care of, reducing the later risk of future issues that can and will arise.

Investment Diversification

Turnkey real estate investing offers the opportunity to diversify geographically as well as by product type (e.g. away from traditional stocks and bonds).

Investors can purchase properties in different markets and cities without needing to be physically present.

This geographic diversification can help mitigate risks associated with local market downturns and allows investors to spread their investments across multiple regions.

This market diversification is particularly helpful when single investors purchase multiple properties across varying geographies.

This diversification can also be associated with the varies property managers that may be available in different markets.

Furthermore, direct investment in individual real estate–while illiquid and risky–can help to provide a differentiated means of recurring income, away from stock dividends and bond coupons.

Cons of Turnkey Real Estate Investing

While turnkey real estate properties can be beneficial to even the most sophisticated investors, there are downsides and risks that should not be overlooked.

Higher Purchase Costs

One of the main drawbacks of turnkey properties is their higher purchase price.

Most real estate investors will tell you:

Your money is made on the buy.

But when you’re not sending mailers, doing the turnkey property rehab or development yourself, then money will inevitably be left on the table.

The convenience and professional services come at a premium, meaning investors may pay more compared to buying and renovating a property themselves.

It’s essential to consider whether the additional cost is justified by the benefits provided.

For instance, when you’re “not in the business of,” then it’s often better to leave such tasks to the professionals, even if the premium goes to the professional.

Your returns will be more boring and long-term in the holding of a quality, real asset.

Sight Unseen Investing

Most individual turnkey acquirers make investments in real estate properties without ever visiting or doing their own physical review of the real estate.

While this slaps in the face of traditional due diligence, it does have its own risks and drawbacks, but when time is limited, it’s often just a part of the process.

For instance, my first eight single-family real estate acquisitions were performed without ever visiting the properties.

It wasn’t until I reached higher scale and more purchasing in my target cities, did I feel visiting was more warranted.

However, when investing in real estate sight unseen I was reliant on trusted partners, knowing they had my absolute best interest in the properties I was buying.

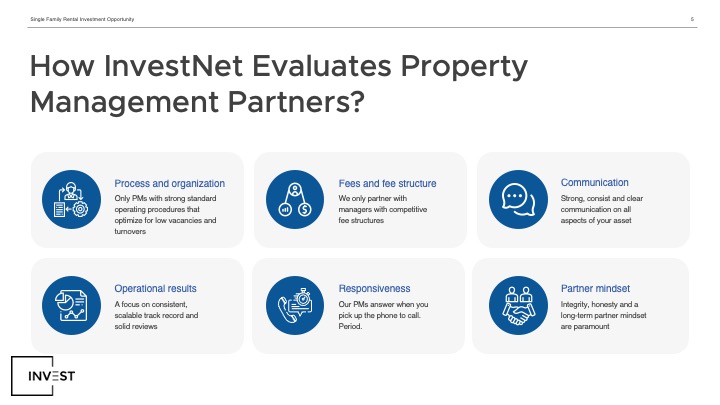

Dependence on the Provider (Particularly the Property Manager)

Investors in turnkey properties are heavily dependent on the turnkey provider.

While some turnkey real estate providers have a soup-to-nuts solution, many of the services you need could be executed by multiple parties with differing levels of quality, which may be concerning.

The quality of the investment hinges on the reliability and performance of the provider. If the provider is not trustworthy or fails to deliver on promises, the investor can face significant challenges.

Conducting thorough due diligence when choosing a provider is critical.

We have outlined processes and best practices on this subject before, but to recap, you will want to understand and know the following parties in detail and how their services, reviews and integrity stack up against your personal goals:

- Rehab/development company

- Real estate brokerage

- Your turnkey property management company, including their subsidiaries for repairs and future maintenance by contractors

- Real estate lawyers

- Investment consultants and intermediaries

Vetting and qualifying each of these groups in various markets can be time-consuming, unless you work with someone like us 🙂

We thoroughly vet each of our regional partners for their performance, ensuring we’re steering investors toward solutions where we too directly invest.

Limited Control

Another downside is the limited control investors have over an individual turnkey property.

Because property management is outsourced, investors may have less say in any decision-making processes.

This lack of input can lead to potential conflicts or dissatisfaction with how the turnkey property is managed when expectations do not meet reality.

Investors must be comfortable with entrusting management decisions to a third party that can often be hundreds of miles away.

Limited control over an asset that may have an attached mortgage is a higher risk than some investors are willing to stomach.

Real Estate Market Risks

Like any real estate investment, turnkey properties are subject to general real estate market risks.

Property values and rental income can fluctuate based on local market conditions, including unpredictable supply and demand.

Investors need to conduct thorough market research to understand the dynamics of the area where they are investing.

Relying solely on the provider’s information can be risky.

Key Considerations for Turnkey Real Estate Investors

If you’re looking at potential turnkey real estate, the following considerations will be crucial for your success as a long term strategy.

Turnkey Property and Provider Due Diligence

Thorough due diligence is paramount when investing in turnkey properties.

Investors should research the provider’s reputation, track record, and the quality of their renovations and management services.

Checking reviews, seeking referrals, and conducting background checks can help in making an informed decision.

In addition, direct property due diligence including understanding the quality of the neighborhood and it’s potentially to progress or regress, which is likely to have an impact on the future potential of your real estate business.

Financial Analysis

Assessing the financial viability of turnkey investments is crucial.

Investors should analyze potential rental income, expenses, and overall return on investment.

Using real estate pro forma tools and metrics such as cash flow analysis, cap rate, and ROI can aid in evaluating the property’s profitability.

Assessing Long-term Goals

Investors should align turnkey investments with their long-term financial and investment goals.

Understanding whether these investments fit into their overall portfolio strategy is essential.

Additionally, considering exit strategies and long-term plans, such as selling the property or holding it for an extended period, will help in making sound investment decisions.

Conclusion

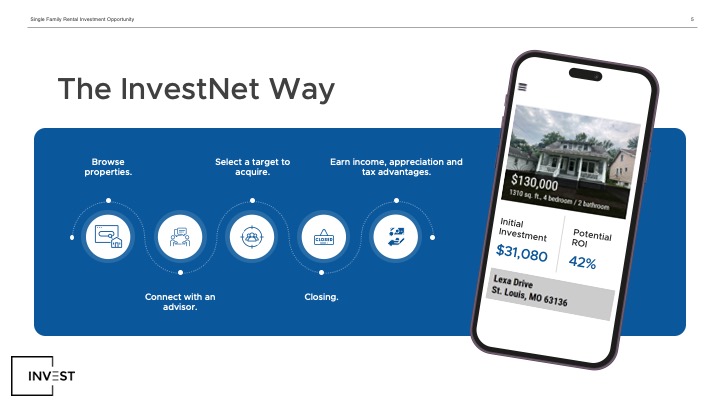

Turnkey real estate investing offers a unique blend of convenience and potential for immediate returns.

However, it also comes with higher costs and risks associated with reliance on providers and market fluctuations.

By weighing the pros and cons and conducting thorough research, investors can determine if turnkey real estate investing aligns with their investment goals and risk tolerance.

If you’re interested in exploring turnkey real estate investments further, contact Invest.net for more information and assistance.

Our team of turnkey rental property experts is here to help you navigate the turnkey market and make informed decisions about your next investment property.

- How to Offset W-2 Income Taxes by Investing in Real Estate - July 19, 2024

- How to Invest in Real Estate Sight Unseen - July 16, 2024

- 19 Reasons Foreigners Should Invest in US Single-Family Real Estate - July 11, 2024