Raising Startup Capital – Why the Investment Banking Model Does not Play Well with Startups

As we have previously outlined, raising startup capital is tough.

It reminds me of the quote often attributed to John Wayne (but still as yet unconfirmed):

Life is hard, but it’s harder if you’re stupid.

If you were to rephrase this to fit in the startup bucket, it would sound something like this:

Raising capital is hard, but it’s harder if you’re pre-revenue.

Unfortunately a lack of revenue is typically not the only disconnect between startups and their investment bankers.

For every profitable company, there are a 100+ looking to raise money on the promise of growth.

The demand for capital will always outstrip the supply.

It’s one of the reasons the Pareto Principle always applies to raising money.

Contents

Startup Defined

The definition of a startup can be very different depending on who you are speaking to. In some cases, a business that is five years old and already profitable may still be rightly referred to as a startup. Others still may adopt “lean startup” methodologies for the purpose of maximizing shareholder benefit. There are also vast differences between varying types of startups. A seed stage startup is going to look very different from a series E and above.

And every startup itself is different. They target different industries, have different end-goals and ultimately will have very different use-of-funds documentation. For the purposes of this discussion, a startup can fall into any number of these buckets but would most likely fit within the bucket of anything pre-profit and below. On the startup spectrum, you can start with pre-revenue on until post-profit. In this respect, Amazon was run as a startup for over a decade until all the post-revenue profit was reinvested into the company to eventually produce staggering post-profit numbers.

Here, let’s assume a startup needs money to survive and scale to the next level and cannot do so by piling additional profits as organic investment back into the business.

Lack of Traction

The first big obstacle and hindrance for startups that seek the aid of investment bankers is their lack of market traction. This is particularly egregious at the pre-revenue stage. They may have a great idea, seemingly solid team and even some protect-able intellectual property, but the reality is they are headed into uncharted waters. The less traction a company has, the less likely they are get investors. The less likely they are to get investors, the less likely they are to convince an investment banker this deals the one for them.

When an investment banker gets a call from a would-be capital raiser, s/he rightly asks many of the questions a potential investor is going to ask. It’s like a mini proctology exam before the proctologist even enters the room. The investment banker does not want to be the one caught with his proverbial pants on the floor.

Some of the questions might include:

- At your current run rate, when will you trend toward profitability?

- How long have you been in business? How long have you been trying to get traction?

- How long have you been out looking for capital?

- What are the sources and uses of funds?

- When do you expect to reach profitability?

- What is the Total Addressable Market (TAM) and what is your plan to penetrate your assumed XX% of said market?

The list goes on. The less traction you have already garnered, the less opportunity you will have to find a quality investment banker to represent you. Why? That investment banker knows your deal is not one that would sell itself. There’s only so much lipstick you can put on the pig. Most startups lack the traction necessary to move them forward toward a completed deal. When you work to engage an investment banker, s/he will be hitching to a wagon whose wheels are simply spinning in the mud with no direction forward.

Fee Push-Back from Issuers

Surprise: investment bankers charge fees. These fees typically include engagement fees and back-end success fees. Pre-profit and especially pre-revenue startups push back on fees heavily when they look to hire an investment banker. They want fees based 100% on contingency. Here are several reasons why that rarely works:

Opportunity cost. Investment bankers who spend their time on contingent deals are likely missing out on other much better opportunities where they could have gotten paid for their time.

Operational costs. Investment bankers have their own operational costs which include compliance, insurance and general operations. These costs are not immaterial. By taking on a wholly contingent deal an investment banker is essentially investing directly in your deal with getting nothing in return. No cash, no equity and only the promise of success. Investment bankers do not work like interns.

Success fees are higher. This will not bode well for the eventually investor, which we will discuss in the next section.

The fact of the matter is that you often get what you pay for. The best bankers will charge you for their services and the best services cost the most. You won’t even be able to wake the sleepy J.P. Morgan team on an engagement that is less than six figures. That’s after they weigh and winnow-out all the other qualitative and quantitative reasons why they will not be taking your deal.

Fee Push-Back from Investors

Success fees at all, let alone high success fees, are never stomached well by would be startup investors. To see 6% to 12% of their investment leave the door before the company starts reinvesting the funds feels like usury and it is. It’s an up-front tax that many venture capital and growth equity groups are unwilling to pay.

This is one of the reason many venture capitalists will not even look at startup deals presented by some investment banker: they do not want to pay fees. If they’re a well-known fund, the proclivity toward kicking the ibankers to the curb is even higher. They have their own quality dealflow. They do not need an investment banker to bring them mediocre opportunities laden with success fees when they can have their pick of the best opportunities.

Contrast this with sell-side M&A deals where the seller ultimately pays the fee to the investment banker and incentives are back in alignment to work with financial investors.

Bloated Valuations

Another area where investment bankers are caught in the cross-fires on startup fundraising is the valuation argument between issuers and investors. It’s always a zero sum game. In the middle-market where unicorns don’t rule, the investors have all the power. They will ratchet founders down to oblivion not only because they can, but because the deal includes a high amount of risk which they should get paid for.

They are not called vulture capitalists because they are being necessarily trying to take advantage of companies. They are structuring deals to protect against the downside.

Believe me, investment bankers hate to be between their issuing client and the would-be investor when talks of valuations surface. Why? I’m typically more prone to lean toward the investor side of the equation. I think like a calculating investor in these types of deals. The risk is so awfully high that a VC or angel investor needs to be compensated for it.

Lack of Equity

It will be important to note that lack of revenue and traction are only part of the equation when it comes to raising capital. Even raising equity on cash-flowing deals can be outcome-nebulous. For instance, would-be business buyers are often interested in sourcing all or some of the needed equity to make an acquisition of one or more companies.

The equity piece of the capital stack is always the most difficult. Similar to the public market world, the supply of capital in the private debt markets is heavily weighted toward debt over straight equity.

When it comes to acquisition financing, equity is always the harder piece of the capital stack to source. A high demand for equity combined with a lower supply from the market, creates a double negative when it comes to sourcing. And, unfortunately for the would-be buyer in such a scenario, the additional time and effort (along with a lower probability of deal closing) creates an investment banking engagement scenario that will cost the acquirer more in both engagement and success fees.

Further still are the very natural time-constraints imposed on most acquisitions. For instance, when an acquirer is able to obtain a mutual, countersigned Letter of Intent (LOI) from a quality target, certain restrictions are often placed on the timeline of the deal. If the seller is comfortable entering into an exclusive, no-shop LOI relationship without proof-of-funding at the outset, s/he is likely to impose a very protracted timeline on the due diligence and funding period. This puts further pressure on an outsourced capital advisory group looking to source either equity, debt or both.

In such situations, it is important to note that the cost, quality, speed trifecta will also be working against you. If you want to raise your capital faster, you will also see an increase in the cost, a decrease in the quality or both. Conversely, obtaining a lower cost of capital will extend the timing of the deal and so on.

Timing Expectations

When startups need capital, they need it yesterday. Unfortunately, investment bankers work in a different space/time reality than the rest of the world. Deal success is measured in months and years, not days and weeks. A “fast” deal–from start to finish–for an investment banker, is six months. Typical deals take 12 to 24 months, regardless of the deal type.

Just reverse engineer the time needed to do a deal starting from the close. 60 to 120 days are typically needed for appropriate due diligence (typically less for a light startup, but some time is required). Then add on the dating period of at least three weeks to a month before an LOI is executed. Then tack on time for marketing and deal preparation (pitchbook and list building) and you arrive at a figure that is six months or more. That’s in the perfect scenario, which is as rare as the startup unicorn.

Even well-funded startups are like the oft-referenced goldfish (or the bloated government) who simply grows to meet the size of his surroundings. Undisciplined and not-so-lean startups have the problem of burning through capital in order to get to profitability more quickly. Without profitability on the immediate horizon, such startups end up in a perpetual state of capital need and capital raising, which takes further emphasis away from business operations.

The solution: hire an investment banker. An investment banker has an expanded network and will take the full-time job away from my plate when it comes to raising capital. At least that is the logic. While this is true, it does not solve the issues related to timing of capital need.

Issuer-Investor Misalignment

There is always an unfortunate gap between investor and issuer. Central to that gap is the issue of valuation. Valuation is so often derived from the risk/reward trade-off in investing. The greater the potential risk, the higher the required return on the side of the investor. Unfortunately, there is often a misalignment not only on valuation, but also on expectations. This misalignment is tied to areas that are often outside of the investment bankers control and desire to negotiate.

Certainly, the best investment bankers will be there to negotiate on behalf of their clients with an investor or group of investors, but much like your real estate agent, investment bankers are more interested in making sure at least A deal gets done, not necessarily THE (best) deal gets done. As far as early-stage deal outcomes are concerned, your investment banker is going to be more interested in any outcome, let alone the one that fits within the issuers highest and best expectations, which only happens in the top 5% of available deals.

Investment Bankers Never Work with Unicorns

The hottest chicks with depth of substance and character never need an introduction, they never need blind dates and they ultimately can typically get exactly what they want. Companies are the very same. The best companies rarely work with or need investment bankers. Their transaction naturally attracts multiple high-brow investors. As such, they typically will get highly-sophisticated board members to their team early. These board members may suggest at least some services from an investment banker within a tight-knit inner circle, but in most cases, the hottest startups are less in need of an investment bankers.

The antithesis of this is that the worst companies (I speak only of those seeking capital) desperately need the services of investment bankers. Such firms are also willing to pay for the services of investment bankers as well. Any potential promise of a hefty raise may drive them pay the engagement and success fees of an investment banker, but my experience is that the cost differential of hiring on a separate investment banker–while it may increase the probability of a successful raise–it’s certainly not a cure-all.

Investment bankers are more likely to be engaged with a unicorn on the sell-side because relationships there matter more. When it comes to startups, the ethereal nature of the startups’ future disenfranchises the best deals from even coming close to using an investment banker.

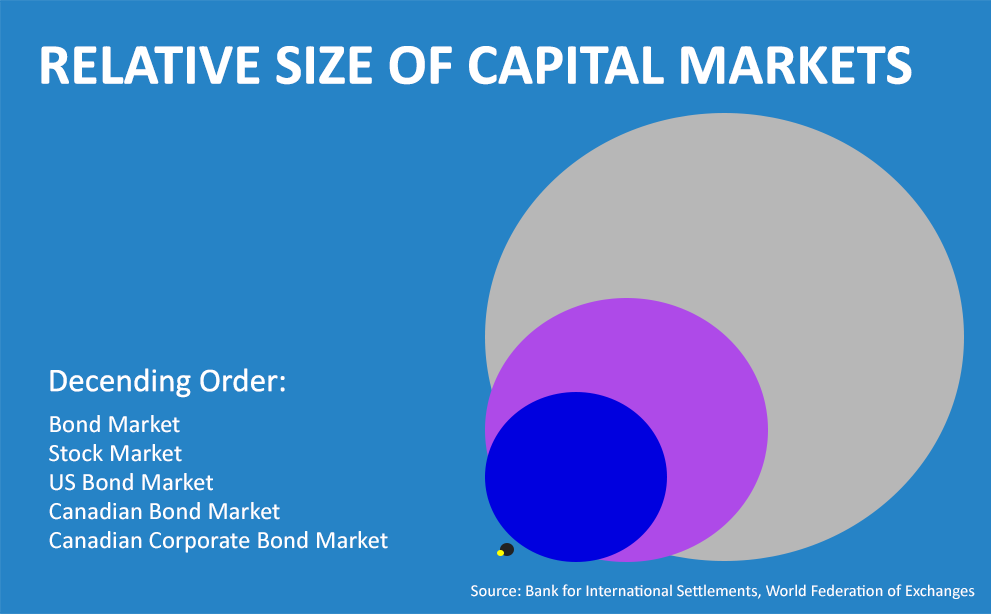

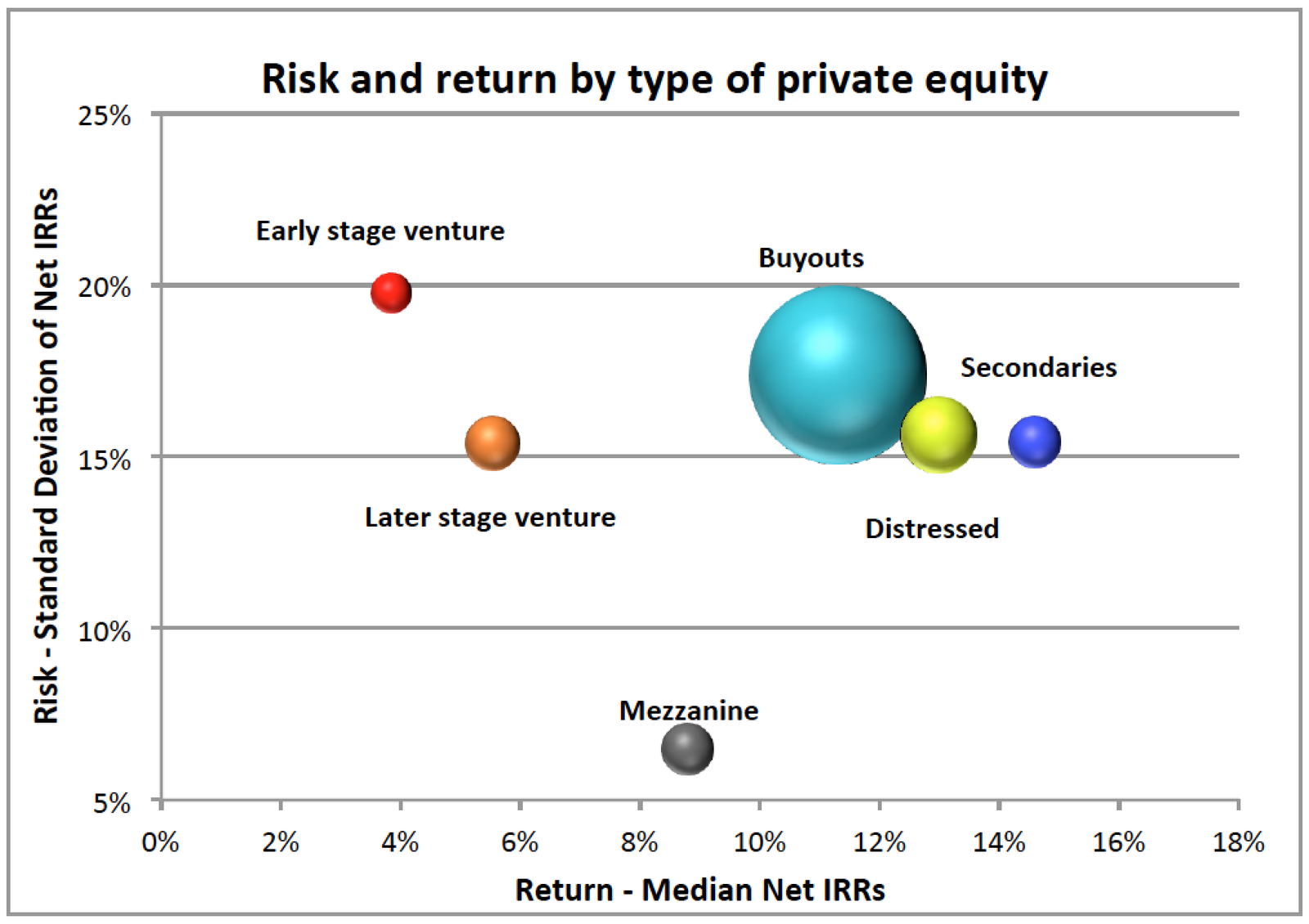

Private Equity & Debt vs. Venture Capital

Like the size differential of public market debt vs public market equities, there is a major size differential between private equity buyout funds and venture capitalist groups.

There are also differences in expected returns among these groups as well.

This again speaks to the supply and demand for capital. More private capital for both debt and equity exists in the realm of buyouts and distressed situations. The IRRs can be greater and often the risk of a flop can be greatly mitigated. This supply-demand differential puts further pressure on the capital need of startups who may be seeking capital, but not finding it.

Some Good & Not-as-Good Alternatives

Here are some venture capital alternatives to using an investment banker to raise startup funds, not necessarily in order of effectiveness:

- Friends and Family. Be careful, you will still be required to eat Thanksgiving dinner with them.

- Private Placements. A PPM drafting and offering memo, typically pushed at accredited investors. A securities attorney is needed, an investment banker is suggested, but not necessary. Most debt and equity crowdfunding falls into this realm.

- Rewards Crowdfunding. Many a successful small business was started as the result of a Kickstarter or IndieGoGo campaign. This process has its own art to it.

Public Offering. When it comes to startups I advise against public offerings in 100% of cases. Perhaps that will change if I find a startup that would work well with a public offering. Unfortunately legal and accounting compliance for public companies makes being one more expensive than the benefit. - Factoring and ABL. These have aptly been referred to as the credit card of accounts receivables and business assets. If you are fine with paying usurious rates for a period of time

- Venture Debt. Just a tweak on factoring without the factor piece. High rates, not equity and typically used well on SaaS-related businesses.

- Angel Networks. Individuals that typically look with the same scrutiny of a VC, but often include a local flair and very different investment mandates.

Conclusion

Some would argue that an investment banker is really only as good as his “who you know” Rolodex. I would argue that investment bankers are a fungible commodity whose services are differentiated only by quality dealflow. It’s not a top-down demand generation issue on the part of the banker, but more of a bottom-up reliance on the deal itself. That’s the biggest reason investment bankers are often picky and annoying when it comes to the deals with which they will engage. As a result, we can often get a bad rapport for being robots without feelings because we only looked at the numbers and not the true market potential, but for me, the numbers should do the speaking for the true potential.