Conventional vs. Non-Conventional Financing

Knowing what sets conventional and non-conventional financing apart is key for any investor in the real estate market. Let’s dive into the main differences between these two ways of getting funds.

Welcome to Invest.net: Pioneers in Real Estate and Private Equity Investment

At Invest.net, we don’t just participate in the real estate market; we innovate it. We know property investment inside out and are all about making our portfolio thrive for the long haul. Think of us as your investing partner, here to give you a fresh take on growing your money together.

Search and find properties that meet your unique ‘buy-box’ criteria for passive investment

Knowing what sets conventional and non-conventional financing apart is key for any investor in the real estate market. Let’s dive into the main differences between these two ways of getting funds.

In the ever-changing real estate investment, non-conventional financing is a lifesaver for anyone wanting to mix up their approach or who can’t use traditional routes. Let’s dive into some top non-conventional financing ways that offer special perks for various investment situations.

In the ever-changing real estate investment, non-conventional financing is a lifesaver for anyone wanting to mix up their approach or who can’t use traditional routes. Let’s dive into some top non-conventional financing ways that offer special perks for various investment situations.

Key Benefits:

Buyers and sellers hash out terms themselves, which can mean tax perks for the seller and lower closing costs.

Key Benefits:

It’s easier to get started, there are more types of investments available, and you can take a shot at big projects that would usually be too expensive.

Key Benefits:

It is faster to get loans approved and funded, there is more wiggle room in setting up the loan, and money is available for unique properties or renovation projects.

Key Benefits:

It offers a way to own a home without upfront financing, sets a future buy price, and lets buyers try out the property first.

Key Benefits:

You can use the money for anything, possibly deduct interest on taxes, and enjoy lower rates than other credit options.

Invest.net stands out in the real estate and private equity landscape due to our deep expertise and innovative approach to non-conventional financing. Here’s why investors and property owners should think about teaming up with us for their money needs:

Navigating the landscape of non-conventional real estate financing can seem daunting, but with Invest.net, it’s easy to get going in a way that fits just right for you. Here’s how to start your partnership with us and make the most of our creative financing choices:

Thinking about trying out some non-conventional financing options to transform your real estate investment strategy? Contact Invest.net today. Our experts are ready to walk you through it all, from the first chat to sealing the deal and everything after. Kickstart a new chapter of smart and profitable property investing with us!

$30,000

$30,000

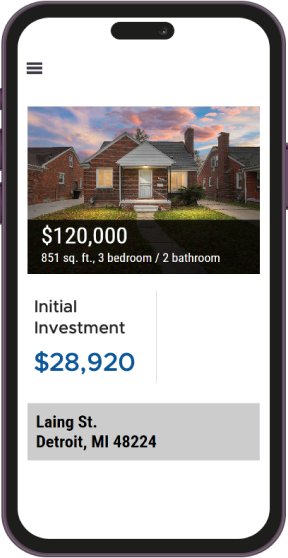

$120,000

$9,101

$758

$30,000

$4,800

$34,800

| INCOME ANALYSIS | YEAR 1 | YEAR 2 | YEAR 3 | YEAR 4 | YEAR 5 | YEAR 10 | YEAR 20 | YEAR 30 |

|---|---|---|---|---|---|---|---|---|

| Gross Scheduled Income | ||||||||

| Less Vacancy Allowance | ||||||||

| Gross Operating Income | ||||||||

| Property Taxes | ||||||||

| Insurance | ||||||||

| Utilities | ||||||||

| Homeowners Association | ||||||||

| Maintenance Reserve | ||||||||

| Property Management | ||||||||

| Total Operating Expenses | ||||||||

| Net Operating Income | ||||||||

| Capitalization (Cap) Rate (%) | ||||||||

| Less Mortgage Expense | ||||||||

| CASH FLOW | ||||||||

| Cash on Cash Return | 4.8% | 6.1% | 7.5% | 8.9% | 10.4% | 18.7% | 41.4% | 75.3% |

| EQUITY ANALYSIS | YEAR 1 | YEAR 2 | YEAR 3 | YEAR 4 | YEAR 5 | YEAR 10 | YEAR 20 | YEAR 30 |

| Property Value | $150,000 | $156,000 | $162,240 | $168,730 | $175,479 | $213,497 | $316,027 | $467,798 |

| Plus Appreciation | $6,000 | $6,240 | $6,490 | $6,750 | $7,020 | $8,540 | $12,642 | $18,712 |

| Less Mortgage Balance | $118,659 | $117,228 | $115,701 | $114,071 | $112,333 | $101,731 | $66,798 | $0 |

| TOTAL EQUITY | $37,341 | $45,012 | $53,029 | $61,409 | $70,166 | $120,306 | $261,871 | $486,510 |

| Total Equity (%) | 24% | 28% | 31% | 35% | 38% | 54% | 80% | 100% |

| FINANCIAL PERFORMANCE | YEAR 1 | YEAR 2 | YEAR 3 | YEAR 4 | YEAR 5 | YEAR 10 | YEAR 20 | YEAR 30 |

|---|---|---|---|---|---|---|---|---|

| Cumulative Net Cash Flow | $1,686 | $3,823 | $6,432 | $9,531 | $13,143 | $19,651 | $34,042 | $60,237 |

| Cumulative Appreciation | $6,000 | $12,240 | $18,730 | $25,480 | $32,500 | $41,040 | $53,682 | $72,394 |

| Total Net Profit if Sold | - | $1,309 | $9,548 | $18,158 | $27,158 | $78,674 | $224,020 | $454,393 |

| Annualized Return (IRR) | - | 10.9% | 15.7% | 17.6% | 18.4% | 18.6% | 17.5% | 16.9% |