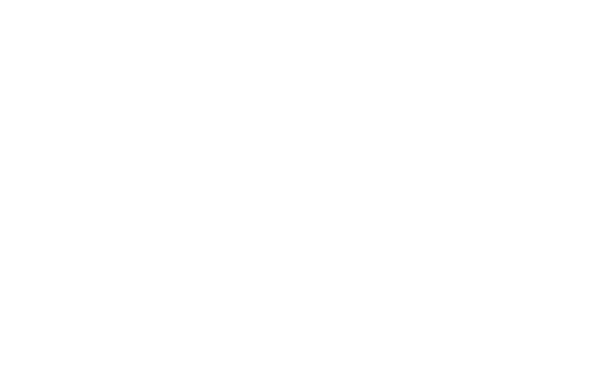

Investing in US real estate has been appealing to international investors due to the relative stability of the US market and potential for high cash and equity returns.

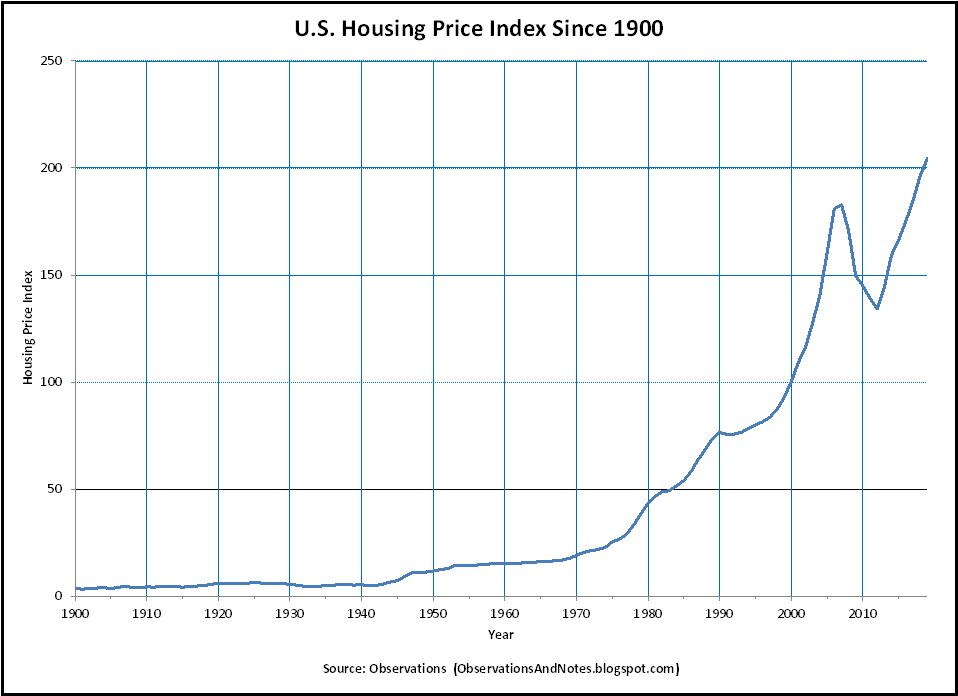

Among the various types of real estate investments, single-family rentals stand out as a particularly attractive option due to their stability, demand, and relative ease of management.

However, no foreign investment comes without risks and potential pitfalls, especially for foreigners acquiring real assets in jurisdictions far outside their home country.

Investing in US single-family rentals as a foreign national can be complex.

Here we discuss a few of the key components to investing in US single family rentals as a non-US citizen.

Let’s jump in.

Contents

- Understanding Domestic & Foreign Investment Structures

- Choosing the Right Markets

- Exploring Alternative US Real Estate Investment Options

- Financing Your Foreign Investment vs. All-Cash Deals

- Navigating Legal and Regulatory Issues

- Currency Exchange and Transfer

- Property Management

- Insurance and Liability Protection

- Understanding the US Real Estate Market Cycles

- Networking and Building Local Team

- Conclusion

Understanding Domestic & Foreign Investment Structures

Direct Ownership

Direct ownership involves purchasing property in your name.

This approach provides full control but comes with significant responsibilities and potential tax implications.

It’s essential to understand the local market and laws in the cities where you are investing.

One of the main reasons this is a critical component for foreign investors acquiring US real estate is because many wealthy non-US citizens have used the liquid US real estate market to acquire properties in all cash transactions and then leveraged against those purchases to fund their lifestyles.

These money laundering schemes have been particularly egregious in states like New York.

Forming a US-based LLC

Forming a Limited Liability Company (LLC) in the US can be beneficial for non-US investors.

An LLC (limited liability company) offers liability protection and can simplify the tax filing process.

This structure also helps in isolating individual investments, reducing personal risk and, in in the past, covering fraud.

However, much of that is now mitigated with the LLC ownership disclosure requirements.

Partnerships and Joint Ventures

Entering into partnerships or joint ventures with local investors or companies can spread risk and provide local market expertise.

Ensure that you structure the partnership agreement clearly to protect your interests and define roles and expectations.

This is one of the reasons we are big proponents of partnering with turnkey real estate property managers in order to assuage ownership risk and ensure steady cash flows.

Choosing the Right Markets

When choosing where to invest, consider factors such as economic stability, rental demand, quality of school districts, property prices, and future equity growth potential.

Researching these aspects helps identify markets with the best potential returns.

Top Markets for Single-Family Rentals

Some top markets for single-family rentals include cities with strong job growth, a large and/or growing renter population, and favorable landlord laws that protect investors.

Examples include Austin, Texas; Raleigh, North Carolina; and Bentonville, Arkansas.

These markets offer a balance of affordability and strong rental demand and large employers.

Exploring Alternative US Real Estate Investment Options

Numerous lucrative real estate investing options exist for foreign investors looking to get into the US market.

REITs (Real Estate Investment Trusts)

REITs allow investors to buy shares in a portfolio of real estate assets.

This option provides diversification and liquidity, making it a convenient choice for those who prefer a more hands-off approach to their US real estate investing.

Crowdfunding Platforms

Real estate crowdfunding platforms enable investors to pool funds to invest in real estate.

These platforms often have lower entry costs and allow you to diversify across multiple properties with minimal capital.

Similar platforms allow for fractional real estate ownership and don’t require complete purchasing.

Agricultural Land

Cash-flowing agricultural land and farmland investments are sought-after foreign investments from non-US citizens.

Agricultural land typically not only maintains its value, but the right investable farmland can provide ample cash returns and appreciation as well.

Certain land investments can prove more lucrative while others may provide negative returns.

Your returns on land investing are typically less secure and can vary widely.

Turnkey Property Investments

Turnkey properties are fully renovated homes ready for tenants.

These properties are managed by professional companies, making them ideal for international investors who want a hassle-free investment.

However, there are pros and cons to turnkey real estate investing.

Each of those should be carefully weighed before taking the leap.

Financing Your Foreign Investment vs. All-Cash Deals

While most foreigners invest in all-cash transactions, there are some options for foreign investors looking to finance US real estate transactions.

Traditional Financing Options

Non-US citizens can obtain financing through US banks and mortgage lenders, though the requirements may be stringent.

Typically, a higher down payment and proof of income and assets are required, if they can even be used at all.

Similar to non-recourse real estate financing, loans by foreign investors are more difficult to obtain and have much more stringent requirements.

Alternative Financing Methods

Private lenders and hard money loans are other financing options.

These loans often have higher interest rates but can be easier to obtain compared to traditional bank loans, but in today’s market, the costs of financing real estate through private lenders can eat away all the returns, particularly after property management and other fees are included.

Using Foreign Income for US Loans

Non-US citizens can use foreign income to qualify for US loans.

This process may involve providing extensive documentation and working with lenders who specialize in international clients.

However, the pool of would-be lenders in this space is admittedly much smaller and the options more limited.

All-Cash Deals

Most foreign buyers opt for all-cash real estate transactions, ensuring they maintain total control and have complete access to the cash flow their properties produce.

Navigating Legal and Regulatory Issues

Any non-US foreigner looking to invest in United States real estate should be aware of the pitfalls and gotchas that could occur when investing in US real estate.

Understanding US Real Estate Laws

Real estate laws in the US vary by state.

It’s crucial to understand both federal and state regulations, especially those concerning property ownership and landlord-tenant laws.

For instance, in recent years states like Alabama, Idaho, Ohio, Florida and Tennessee have placed restrictions on foreign ownership of US domestic real estate assets.

Tax Considerations

Non-US investors are subject to US taxes on rental income and capital gains.

To minimize tax liability, consider strategies such as using deductions and forming an LLC.

Hiring a tax advisor with experience in international real estate can be invaluable and is always advisable.

Avoiding Legal Pitfalls

Common legal issues include zoning laws, tenant disputes, and property management regulations may come with unexpected consequences to foreign buyers unfamiliar with US federal and state laws.

Avoid these pitfalls by conducting thorough due diligence and hiring local legal and tax advisors.

Currency Exchange and Transfer

Exchange Rate Fluctuations

Exchange rate fluctuations can impact your foreign investment returns.

To mitigate this risk, consider using hedging strategies or holding funds in US dollars.

Transferring Funds Internationally

Transferring large sums internationally can be expensive and complex.

Use efficient and cost-effective methods such as online transfer services or working with banks that specialize in international transactions.

In some cases, there may be tax liabilities or even proof of fund requirements for compliance with the money laundering provisions of the Patriot Act.

Property Management

Hiring a Property Management Company

Hiring a quality property management company is crucial for international investors in US real estate.

Your property management company will handle tenant management, maintenance, and rent collection, ensuring your property is well-maintained, retains its value and produces cash flow long into the future.

DIY Property Management

Managing a property remotely is possible with the right tools and resources. However, this isn’t necessarily immediately advisable until you can get to know the right contractors and contacts in the local market.

Consider using property management software and hiring local contractors for maintenance needs.

Insurance and Liability Protection

Ensure your foreign investment is protected with BOTH property and liability insurance.

Property insurance covers damage to the property, while liability insurance protects against legal claims.

These are essential for operating and protecting against downside risk.

It is also wise to consider additional protection strategies such as umbrella policies and structuring ownership through an LLC to limit personal liability.

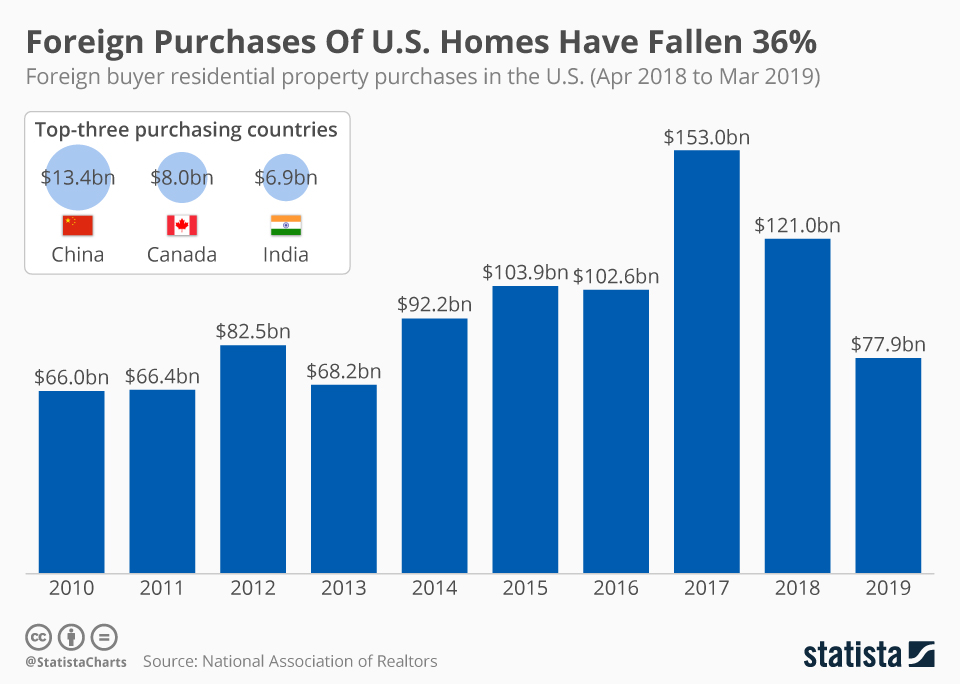

Understanding the US Real Estate Market Cycles

The US real estate market follows cycles of growth and decline.

Each relative market follows its own cycle. Recognizing these phases can help you time your foreign investments for maximum returns.

Key indicators such as employment rates, GDP growth, and housing demand can provide insights into market conditions and help you make informed investment decisions.

Networking and Building Local Team

Having a local team is crucial for successful real estate investment, particularly if you as a foreign property owner act as a DIY property manager.

Your team should include a real estate agent, attorney, accountant, and contractors to handle various aspects of your foreign investment.

Networking with other investors via real estate investment groups can provide valuable insights and opportunities.

Plan to join local or online real estate investment groups to connect with like-minded individuals and gain knowledge from their experiences.

Conclusion

Investing in US single-family rentals can be a lucrative opportunity for non-US citizens.

By understanding investment structures, choosing the right markets, exploring financing options, and navigating legal issues, you can successfully invest in this stable and profitable market.

Conduct thorough research, seek professional advice, and consider partnering with local experts to maximize your returns and minimize risks.

For personalized foreign investment advice and opportunities, contact one of the investment consultants at Invest.net. Explore additional resources and guides for non-US investors to make informed and strategic investment decisions.

- How to Offset W-2 Income Taxes by Investing in Real Estate - July 19, 2024

- How to Invest in Real Estate Sight Unseen - July 16, 2024

- 19 Reasons Foreigners Should Invest in US Single-Family Real Estate - July 11, 2024