Smart business owners are always on the lookout for opportunities to improve their business as well as their personal financial position outside of that business. They want ways to make more money, better utilize the money they have, and protect themselves from risk.

Fortunately, there’s a product that can address nearly all of these goals simultaneously: whole life insurance.

But what exactly is whole life insurance and how does it benefit business owners?

Contents

Whole Life Insurance: The Basics

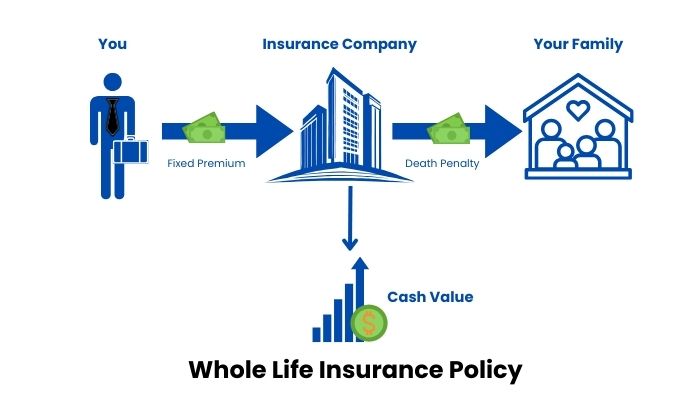

Whole life insurance is a type of life insurance product. Life insurance, as you’re probably already aware, is a type of insurance policy designed to protect named beneficiaries in the event of death or incapacitation of the policyholder. If you continuously pay for a life insurance policy, it will likely pay out nominal benefits to your name to beneficiaries upon your death.

Whole life insurance is a specific type of life insurance that’s permanent, tax advantaged, and consistent. A whole life insurance policy is designed to protect you for your entire life; it doesn’t have a date of expiration, like term life insurance. Additionally, it’s associated with consistent premiums that shouldn’t increase for as long as you continue remaining as a policyholder.

As you continue making payments, the cash value of your policy will increase; during your life, you may qualify for making withdrawals from this cash value, or you may be able to borrow against it. This is especially appealing to investors looking to multiply their potential borrowing power. Some whole life insurance policies qualify for dividends, and nearly all of them are tax deferred, meaning you won’t owe taxes on your contributions or your growth until you start making withdrawals.

Because whole life insurance is permanent, consistent, and advantageous in so many other ways, its premiums tend to be higher than those of term life insurance policies. However, for many business owners, these increased premiums are more than worth it.

Use Cases

You can use whole life insurance in many different areas of your business.

- Personal life insurance. For starters, you may want a whole life insurance policy for yourself. As a business owner, you’re an important person to both your employees and your family. Having a life insurance policy could be a way of giving them both further financial protection.

- Life insurance as an employee benefit. Many business owners also choose to offer whole life insurance as a benefit to their employees. People may be more willing to work for your business or stay with your business if they have this type of financial protection.

- Life insurance as a business protection. It’s also possible to use whole life insurance as a way to protect your business. For example, you can use the cash value of a whole life insurance policy to fund the business directly, or you could take out a policy on a critical employee so the business is protected if they die or are incapacitated.

The Benefits of Whole Life Insurance for Business Owners

There are many potential benefits of whole life insurance for business owners, depending on how you use this type of policy.

These are some of the most important to recognize:

- Consistent premiums. Business owners appreciate whole life insurance, specifically, in part because of its consistent premiums. Once you establish this type of policy, you should never see a premium increase unless you make changes to that policy.

- Permanence. Whole life insurance is a type of permanent life insurance, so named because it’s designed to stay with you for your entire life. Whatever happens to the business, the economy, or the world at large, your policy should remain in effect.

- Available capital. Some business owners appreciate whole life insurance for its appreciating cash value, which can function as a Bank of additional capital. If your business falls on hard times, or if your family is hitting a financial roadblock, you can make some withdrawals and cover your needs. Just keep in mind that certain types of withdrawals may be associated with tax penalties.

- Loans and financing. As a financial instrument, whole life insurance can serve as a basis to increase your borrowing power. If you choose to borrow against the cash value of your whole life insurance policy, you can take out more loans, funding the business, new investments, or basically anything else you want. Of course, you’ll need to keep risk in mind, as borrowing too much can lead to overleveraging.

- Attraction and retention of employees. If you decide to offer whole life insurance as a benefit to your employees, this type of policy can help you attract and retain top talent. The best employees in your industry aren’t just after a higher salary; they want benefits like these from their employers.

- Risk management for key employees. When utilized correctly, whole life insurance functions as risk management for your top employees. If you have major partners or leaders who are indispensable for the business, you can take out a life insurance policy on them and protect the business in the event of their death.

- A succession plan. Similarly, if there is a partner or leader within the organization largely responsible for continuing to fund the operation, a life insurance policy can avoid interruptions in funding in the event of their death.

- Peace of mind. If the economy starts to struggle, you’ll have a bank of additional capital to draw upon. If you lose a key employee, you’ll have extra money to help you survive. If there are new investments you need to make, you can borrow the money you need to make them. Ultimately, whole life insurance is all about giving you peace of mind.

How to Choose the Right Whole Life Insurance Policy

So how do you choose the right whole life insurance policy?

You can start with the following process:

- Determine your needs. Start by outlining your needs. What kind of terms are you looking for? What kinds of death benefits and cash value appreciation are you looking for? What is your budget and what would justify changing it?

- Get quotes. There are many whole life insurance policy providers out there, so get multiple quotes and compare them apples to apples. Consider talking to insurance agents to make sure you fully understand all the details of each policy.

- Get started. Once you find a policy that meets all of your needs, you can sign the paperwork and get started.

When reviewing different types of whole life insurance, pay close attention to the following variables:

- Cash value and accumulation. How is cash value calculated? What is the path to cash value accumulation? What is the cash value projected to be in the next few years? How will that grow over the decades to come?

- Dividends. Does this policy pay dividends? If so, will they be funneled directly into the cash value of your insurance policy?

- Surrender period. Many whole life insurance policies come with an initial surrender period, in which you’ll have the option to close the account early. Does this option exist for your chosen policy? If so, how long does it last?

- Living benefits. Some policies come with living benefits, in addition to standard death benefits, providing for named beneficiaries in the event of your hospitalization or incapacitation. These may or may not be worth paying for, depending on your priorities and your budget.

- Premiums. What will the premiums of this policy be? Generally, whole life insurance is more expensive than term life insurance, but the premiums are also consistent throughout your life. This makes whole life insurance easy to budget for and relatively easy to manage. However, you’ll need to make sure your premiums fit with your budget and long-term financial planning. Keep in mind that it’s possible to practice overfunding by paying more than the standard premium; this can increase the cash value of your policy more rapidly, though there are some additional drawbacks to consider.

- Riders. You can expand the vision of your whole life insurance policy by adding riders. For example, you may want a rider to waive insurance premiums in the event of your disability, or a rider to increase your death benefit later in life.

Confused about life insurance?

It’s totally understandable.

We’ve helped thousands of people like you figure out the details and decide on the life insurance policies that fit best with their needs. If you’re interested in whole life insurance for yourself, your business, a key employee, or someone else entirely, contact us today!

- 10 Reasons for Optimism in the U.S. Housing Market (and Compelling Counters) - December 10, 2024

- Is This Real Estate Property Truly Turnkey? 13 Things to Check - November 8, 2024

- Are “As Is” Properties Worth Considering as a Real Estate Investor? - October 28, 2024